| To qualify |

a. You must possess at least 5 years of entrepreneurial, investment or management track record; AND

b. You must have net investible assets of at least S$200 million.

(NB: Net Investible Assets include all financial assets, such as bank deposits, capital market products, collective investment schemes, premiums paid in respect of life insurance policies and other investment products, excluding real estate. Contact Singapore reserves the right to exercise judgement in determining the suitability of the applicant's Net Investible Assets.) |

| #Investment Options C |

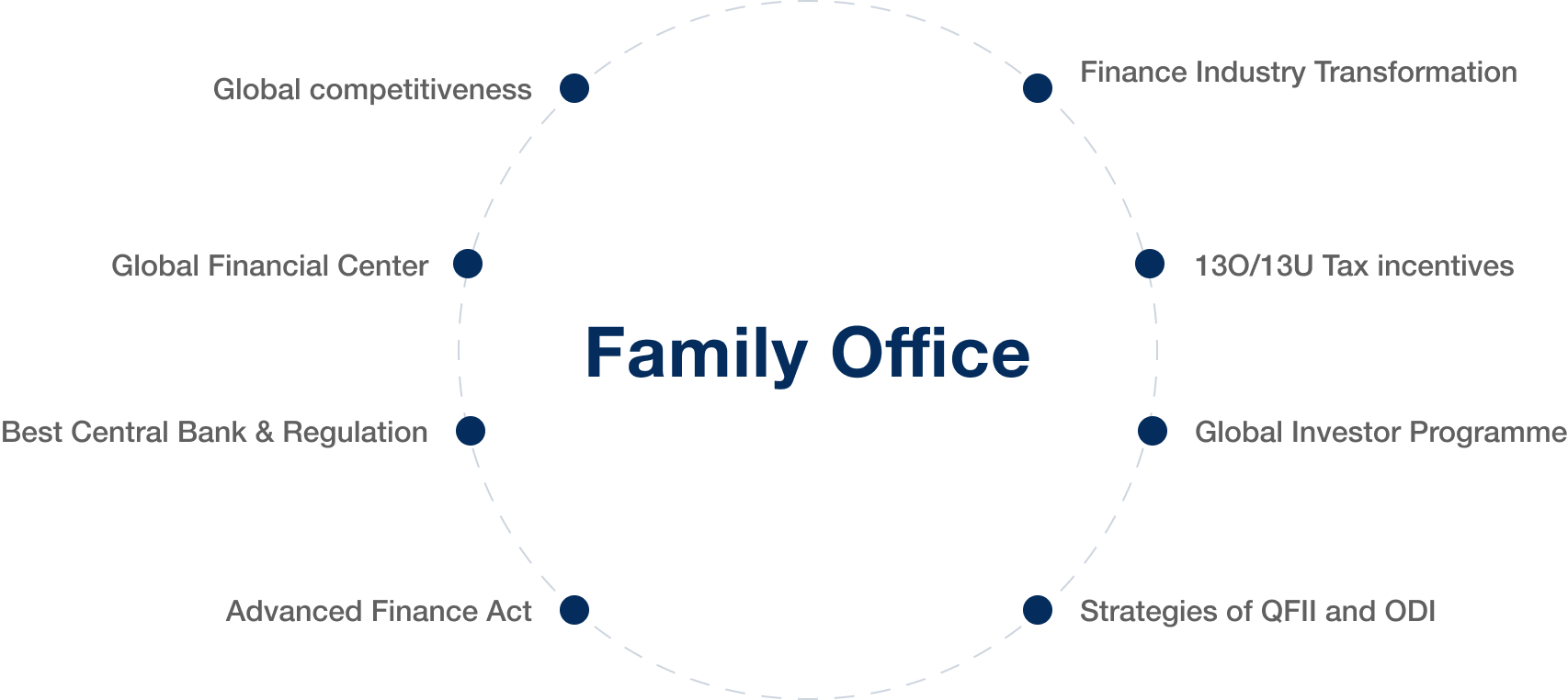

Establish a Singapore-based Single-Family Trust Fund with Assets-Under-Management (AUM) of at least S$200 million, where minimally S$50 million must be deployed in any of the 4 investment categories of:

- 1. equities, REITS or business trusts listed on Singapore-approved exchanges;

- 2. qualifying debt securities listed on MAS' enquiry system;

- 3. funds distributed by Singapore-licensed/registered managers or financial institutions; and

- 4. Private Equity Fund investments in non-listed, Singapore-based operating companies.

|

|

● l Applicants who apply for Option C must submit a detailed 5-year business plan with projected employment and annual financial projections (as outlined in Form B of the GIP Application Form, available at http://www.edb.gov.sg/gip). The business plan will be assessed based on your role in your Single-Family Trust Fund, the functions of your Family Trust Fund, your proposed investment sectors, asset types, geographical focus and philanthropy interest.

● l Offshore assets can be qualified as part of the AUM requirement, provided at least S$50 million investible AUM has been transferred into and held in Singapore upon Approval-in-Principle of your PR status. At least S$50 million must be deployed in any of the below 4 investment categories no later than 12 months from the Final Approval of your PR status, and thereafter maintained throughout the validity of the Re-Entry Permit:

- Equities, REITS or Business Trusts listed on Singapore-approved exchanges;

- Qualifying debt securities listed on MAS’ enquiry system;

- Funds distributed by Singapore-licensed/registered managers or financial institutions; and

- Private Equity Fund investments in non-listed, Singapore-based operating companies.

|